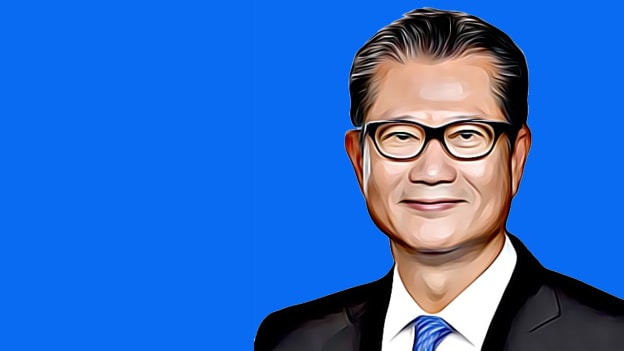

Hong Kong government extend tax reduction rate to 100%

Hong Kong financial secretary Paul Chan Mo-po announced his plans to increase the reductions of salaries tax, tax under personal assessment and profits tax from 75 percent to 100 percent for the year of assessment 2018-19 while retaining the ceiling of HK$20,000.

It is reported that about 1.43 million taxpayers will benefit from this, while about 93 percent of these taxpayers do not need to pay any tax.

Chan reinforced that the relief measures were not a response to the anti-extradition bill protests.

The decision is based on the government’s assessment on the current economy and as a safeguard against future economic situations.

The external environment — the escalation of China-US trade tensions, imminent risk of a hard Brexit, continued geopolitical tensions in the Middle East, sluggish industrial and trading activities in Asia, heightening financial market volatilities, and market concerns about major economies slipping into recession — and the local economic environment are leading Hong Kong into economic uncertainty.

Chan was quoted saying, “The economic measures that we have just announced are trying to tackle the current economic difficulties and the coming economic headwind. It is not related to the political difficulties that we are facing. In my opening remarks, I refer to the political difficulties in order to avoid any confusion between the two. As to the upcoming economic situation, it is indeed very challenging. The escalating tension between the US and China, no matter on the trade front or the technology side, both are escalating, not to mention the possible spill-over to the financial market.”