Global economy makes slow progress, but challenges persists: IMF

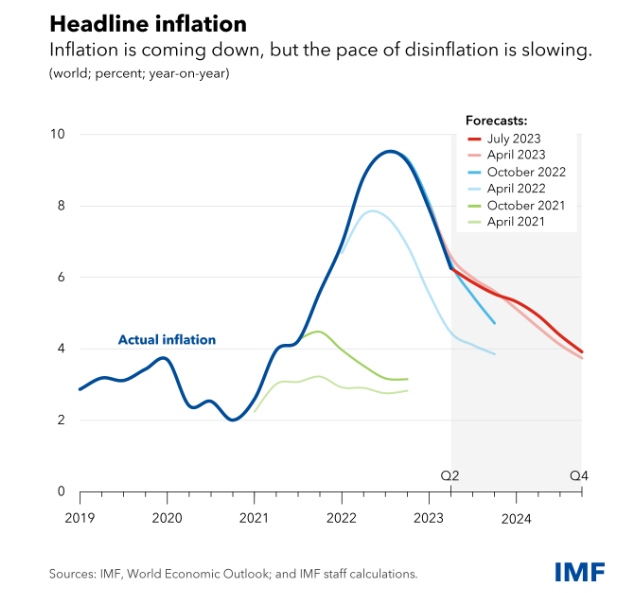

Global inflation is projected to decline from 8.7% last year to 6.8% in the current financial year, according to the IMF's World Economic Outlook Report 2023. The report signals a positive global economic direction, analysing growth projections, inflation rates, and policies of advanced, emerging, and developing economies.

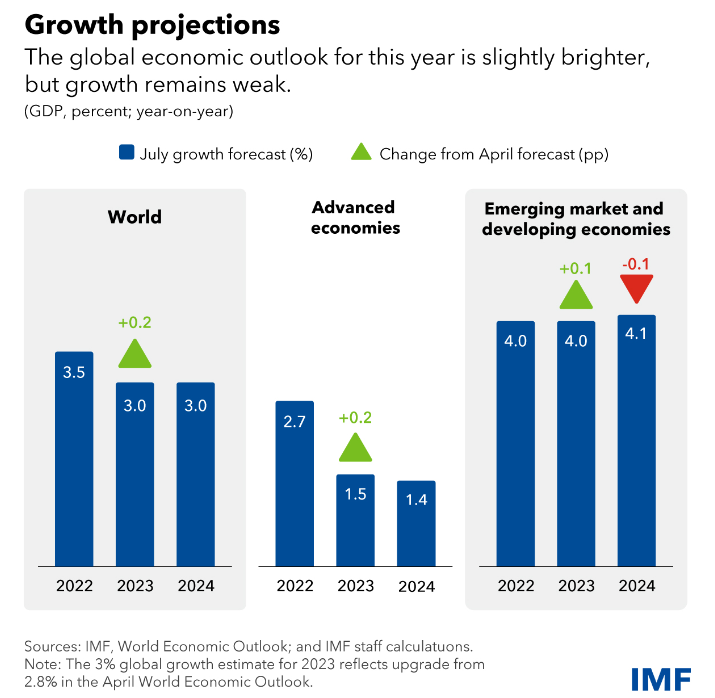

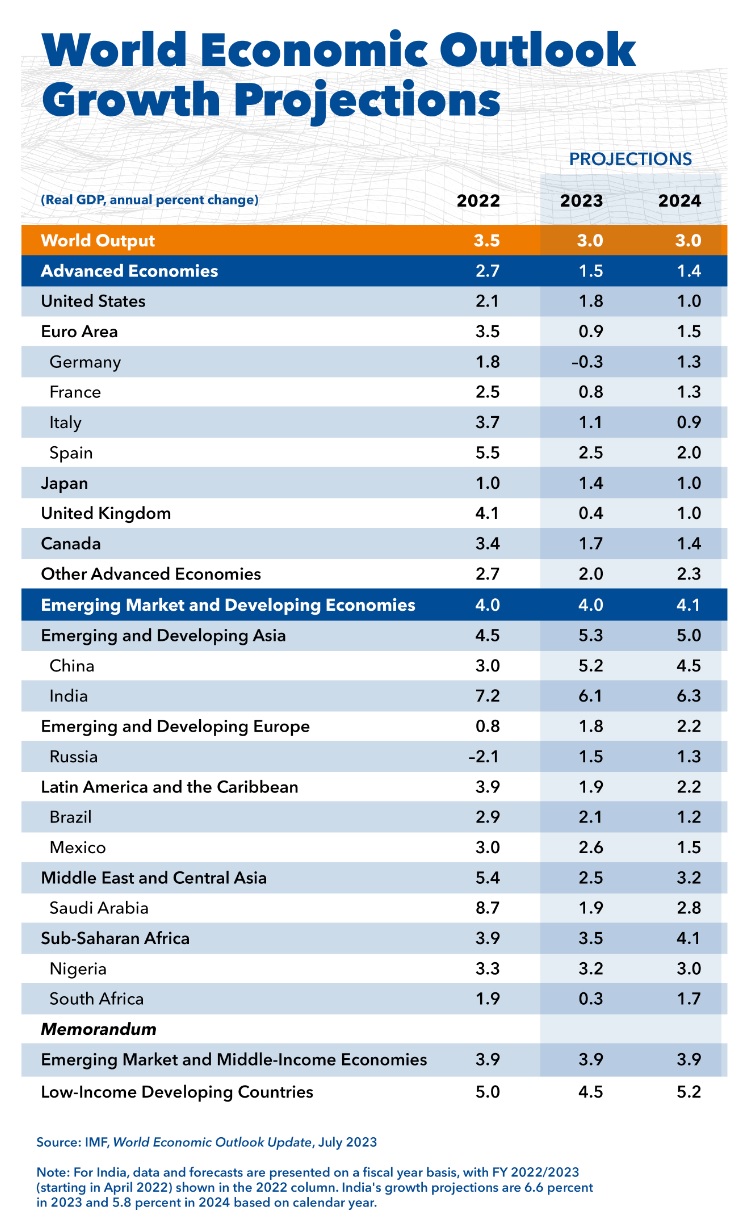

The report stated, ‘Under our baseline forecast growth will slow from last year’s 3.5 per cent to 3 per cent this year and next, a 0.2 percentage points upgrade for 2023 from our April projections. Global inflation is projected to decline from 8.7 per cent last year to 6.8 per cent this year, a 0.2 percentage point downward revision, and 5.2 per cent in 2024. The slowdown is concentrated in advanced economies, where growth will fall from 2.7 per cent in 2022 to 1.5 per cent this year and remain subdued at 1.4 per cent next year. The euro area, still reeling from last year’s sharp spike in gas prices caused by the war, is set to decelerate sharply.”

- Growth projection shows emerging markets and developing economies require YOY growth from 3.1 per cent (2022) to 4.1 per cent in the current year and thereafter.

- Moreover, Asia’s emerging and developing markets show steady development with 5.3 per cent in the current year, but a decline in export revenues for major manufacturers.

Suman Bannerjee, CIO of Hedonova, a US-based Hedge Fund on the IMF India’s GDF forecast stated, “India's GDP will rise due to strong tech and service sector growth, increased foreign investment, favourable demographic dividends, governmental policy reforms facilitating business, and a predicted recovery in consumer spending post-Covid-19, contributing to a healthier overall economic outlook. The forecast of 6.1% is pessimistic, I expect it to be 6.3%. A weak rupee has fostered more exports which have reduced the current account deficit and increased remittance income from $55.6 billion to $62.3 billion. Oil prices have been lower due to purchases from Russia and Iran over Norway, USA and Saudi Arabia and overall lower oil prices have kept the balance of payment account in check.”

Analysis of risks and inflation rate

The report reveals that ‘steady growth and lower inflation’ are positively impacting the global economy. However, despite the moderation of adverse risks, the overall balance still remains tilted towards the downside. The insights from the report show:

Global activity is losing momentum due to reinforced monetary policy, resulting in credit growth, increased interest rates, and real estate market pressure. In the US, savings from pandemic-related transfers that supported the economy during the period of crisis, have nearly exhausted. Additionally, China's recovery shows signs of stalling amid rising concerns for the real-estate sector, impacting the global economy.

Moreover, core inflation remains significantly above central banks' targets. It is projected to gradually decrease from 6 per cent in 2023 to 4.7 per cent in 2024. The core inflation situation in advanced economies is still a concern:

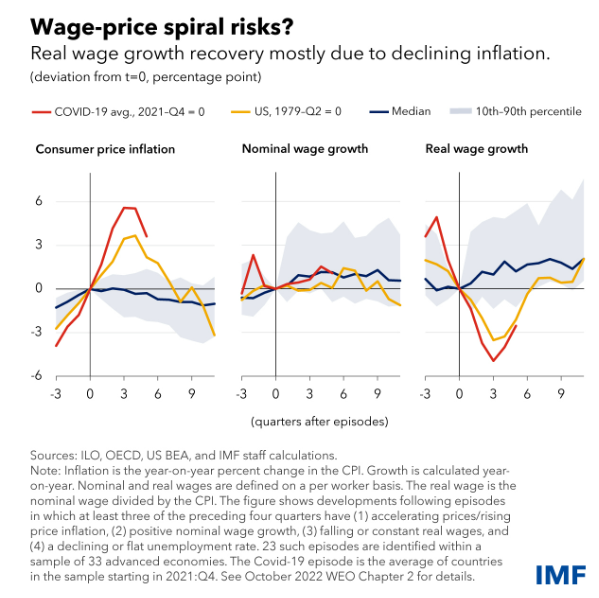

Furthermore, labour market developments and wage-profit dynamics are the key contributors to inflation. As compared to labour markets from the pre-COVID era, currently,

- There is a reduction in the unemployment rate and an improvement in the employment scenario.

- Although wage inflation has improved, it is yet to strike price inflation in most economies.

- The simple reason is that nominal demand significantly exceeds the economy's production capacity, and prices increase faster than wages. Here ”greedflation” has no role to play.

- Consequently, real wages for advanced and large emerging market economies have declined by nearly 3.8 per cent in the last year.

Pierre-Olivier Gourinchas, Economic Counsellor and the Director of Research of the IMF said, “If labour markets remain strong, we should expect—and welcome—real wages to recover lost ground. This means nominal wage growth will remain strong for a while even as price inflation declines. Indeed, the gap between the two has started to close. Because average firms’ profit margins have grown robustly in the last two years, I remain confident that there is room to accommodate the rebound in real wages without triggering a wage-price spiral. With inflation expectations well-anchored in major economies, and the economy slowing, market pressures should help contain the pass-through from labour costs to prices.

These labour market developments matter enormously. In the near term, should economic conditions deteriorate, the risk is that firms might reverse course and sharply scale down employment. Separately, the strong recovery in employment, coupled with only modest increases in output, indicates that labour productivity—the amount of output per hour worked—has declined. Should this trend persist, this would not bode well for medium-term growth.”

Financial conditions have improved despite tightening policies and reduced bank lending since March 2023. Moreover, Equity markets have improved, especially Artificial Intelligence in the technology sector. The dollar has depreciated further due to market expectations of a more lenient path for US interest rates and increased risk appetite, which is providing relief to emerging and developing countries. However, a risk of sharp repricing is expected, leading to a flight to dollar-safe assets, higher borrowing costs, and increased debt distress.

Spillover of policies led inflation

The inflationary cycle, which began in 2021, is slowly subsiding but some challenges are yet to overcome. The report shows,

- Currently, inflation risks are balanced, and major economies are less likely to require further significant increases in policy rates. Latin American economies have reached their peak rates, already.

- However, it is essential to avoid prematurely easing rates until underlying inflation consistently shows signs of cooling, which has not happened yet.

- Meanwhile, central banks should remain vigilant in monitoring the financial system and be prepared to use other tools to ensure financial stability.

Gourinchas remarked, “After years of heavy fiscal support in many countries, it is now time to gradually restore fiscal buffers and put debt dynamics on a more sustainable footing. This will help to safeguard financial stability and to reinforce the overall credibility of the disinflation strategy. This is not a call for generalized austerity: the pace and composition of this fiscal consolidation should be mindful of the strength of private demand while protecting the most vulnerable. Yet, some consolidation measures seem entirely appropriate. For instance, with energy prices back to their pre-pandemic levels, many fiscal measures, such as energy subsidies, should be phased out.”

The report concludes that:

- There is a need for fiscal space to implement crucial reforms in emerging and developing economies.

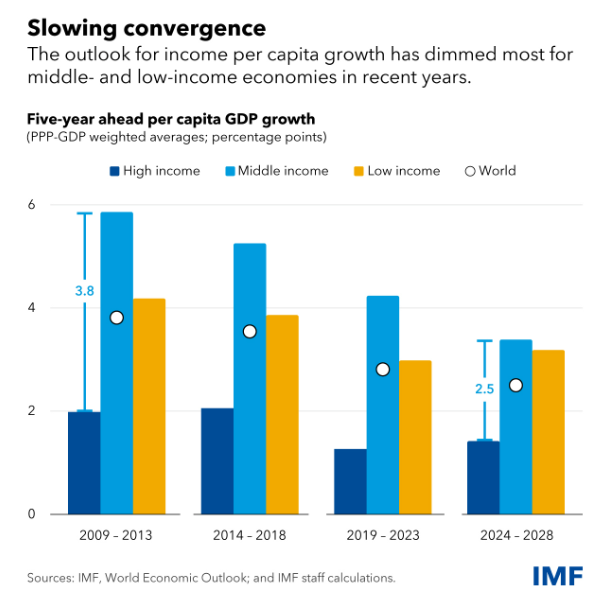

- Medium-term growth in income per capita has weakened over the past decade, especially for low and middle-income economies compared to high-income ones.

- Prospects for catching up to higher living standards have significantly diminished in emerging and developing economies.

- Elevated debt levels are preventing many low-income and frontier economies from making vital investments to boost their growth, as high risks of debt distress exist in several regions.

- Encouraging progress has been made in debt resolution for Zambia, but other highly indebted countries need faster progress.

- The spillover of policies resulted in the global slowdown.

- Additionally, geoeconomic fragmentation, leading to the division of the global economy into rival blocs, will have the most significant impact on emerging and developing economies, which heavily depend on an integrated global economy, FDI and technology transfers.

- Inadequate progress on the climate transition will disproportionately affect poorer nations, making them vulnerable to severe climate shocks and rising temperatures, despite contributing only a small portion of global emissions.

- Multilateral cooperation remains the most effective approach to secure a safe and prosperous economy for all.